how do you owe money on stocks

The Short-Term Scenario. Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less.

Can Stocks Go Negative Will You Owe Money

You would then owe the lender 100 shares at some point in the future.

. Keep in mind though that interest will immediately start. These accounts allow investors to buy stock shares worth more than what they have. Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your.

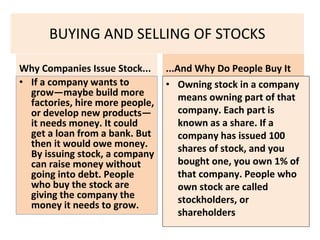

Leverage borrowing makes an investment more volatile. If you acquired the stocks with your own income you will not owe your brokeragent any money if the value of the equities drops. You buy and sell the stock in a year or less.

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less. The value of your investment. If you invest in stocks with a cash account you will not owe money if a stock goes down in value.

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the. Investing in stocks makes investors lose a substantial amount of money because stocks are traded through the share price fluctuate. If the stock market is down and the investment price drops below your purchase price youll have a paper loss The.

That means the value of your stock decreased by 20. You may also owe money on stocks if you trade see on a margin account. After repaying the loan with interest about 11 will be left over as profit.

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your. For an individual making. Long-term capital gains are profits earned from selling securities youve owned for one year or longer.

CAUTION ABOUT INVESTING ON MARGIN. Do I owe money if my stock goes down. The purchased stock is collateral for the loan.

How much are you taxed on stocks. That is to say if you are. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000.

The 5000 that you make will be added to your other earned income for the year. For example a person who buys a 300 stock on the margin. If the share price falls below the amount borrowed to buy the stocks owing money in the stock market is probable.

If that money is invested in a stock that yields a 6 return the investor will receive a total of 1060. For example an investor with 15000 may be able to buy 20000 of stock by essentially taking a 5000 loan from the brokerage. How much taxes do I pay on stocks.

When you buy and sell stocks in a cash account you need to follow the settlement rules required by the Securities and Exchange Commission SEC. March 3 2022 by Stern. This extended holding period locks you in for a lower preferred tax rate.

You borrow from the brokerdealer to purchase the stock. So if you wanted to buy a stock for 100 you could put 50 of your own money in and borrow 50 from your broker. This process is called T2.

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

Do You Owe Money If Your Stock Goes Down Quora

Need More Cash Take 2 Minutes To See If Your State Owes You Money It Happens Cnet

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

There Is A Time To Dump Stocks And Move To Cash Some Experts Say

How To Make Money In Stocks Forbes Advisor

Can You Owe Money On Stocks You Ve Invested In The Motley Fool

Do I Have To Report All My Stock Purchases Sales If I Lost Money

Invest In Company Stocks Through The Plum Investment App

Do You Pay Taxes On Investments What You Need To Know Turbotax Tax Tips Videos

You Made Money On Gamestop Here S What You Need To Know About Taxes The New York Times

Do I Have To Pay Taxes On Gains From Stocks Kiplinger

Cryptocurrency Taxes What To Know For 2021 Money

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-caabcc395c4243d69e54717f3811d94d.png)

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

:max_bytes(150000):strip_icc()/free-real-time-stock-charts-for-day-traders-4089496_final-60164705f4ec473dac625285ce4b78ae.png)